Investors going quiet? Find out why - and what to fix first.

You’ll know whether you’re actually fundable AND exactly what’s blocking the yes.

In one focused 90-minute audit, designed by an operator who evaluates businesses the way investors do, we diagnose what’s blocking investor confidence across Proof (traction & metrics), Story (clarity & positioning), Process (how you run a raise), and Founder Readiness - then deliver a 2-page action plan within 48 hours so you know exactly what to do next.

-

No funding promises. No fluff. No vague advice.

-

Built for founders who want clarity fast (and will act on it)

-

Includes your Investor Readiness Score (0–100) + Top 5 fixes in order

-

Ends with a clear recommendation: 4-week Sprint vs 90-day Accelerator

Founders who complete this Snapshot typically say it saves them months of guessing and misdirected fixes.

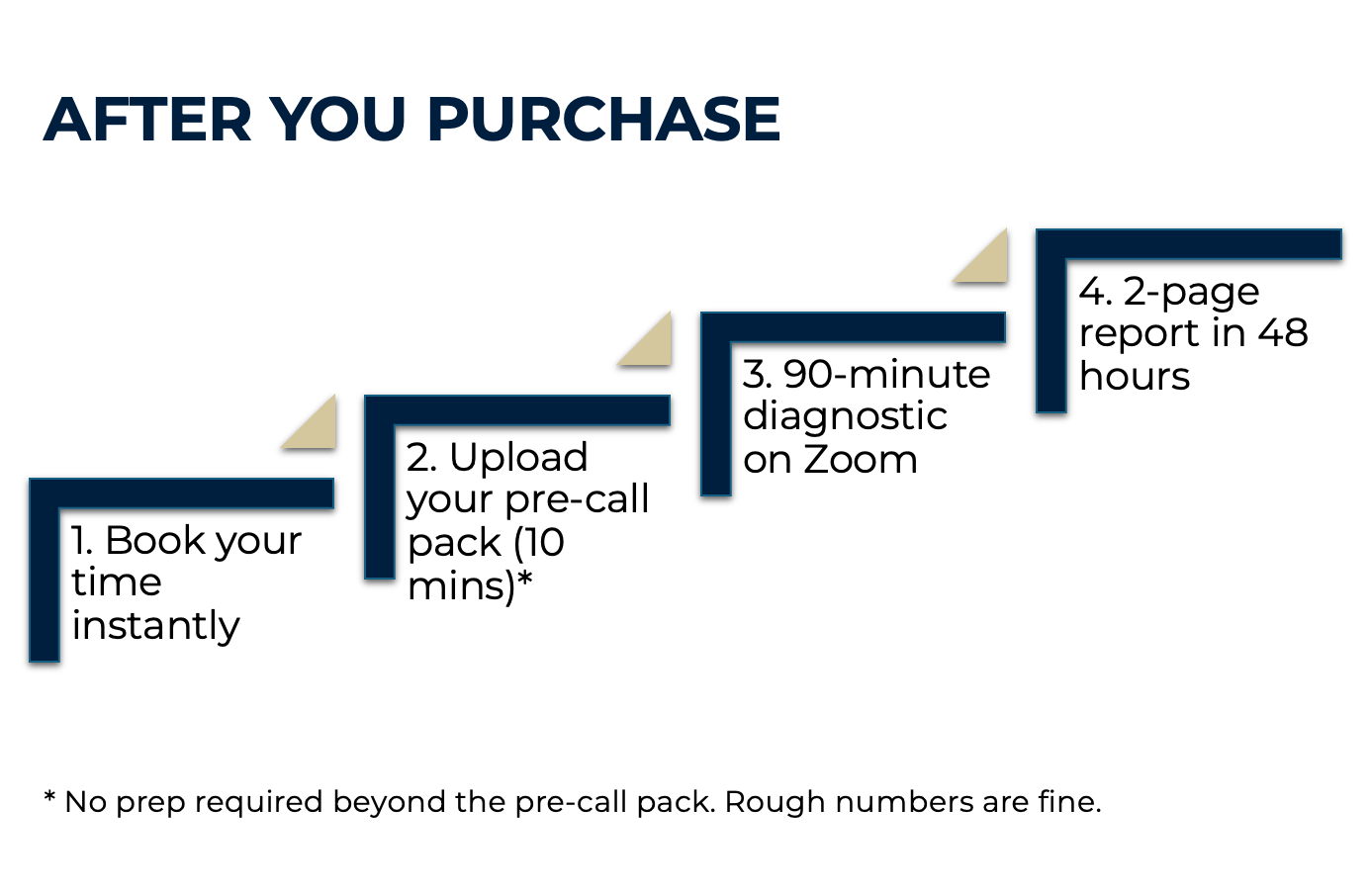

After checkout, book immediately.90 minutes. 48-hour report. 5 Snapshot slots weekly.

This is a paid diagnostic - not a sales call.

If investors are going quiet, it’s rarely “the market"

If you’re hearing things like…

-

“Not yet… check back in a few months.”

-

“Interesting, but we need more clarity on…”

-

Strong first conversation… then silence

-

You keep tweaking the deck but nothing changes

… you don’t have a networking problem.

You have an underwriting problem: something in your proof, story, or process doesn’t feel investable yet.

Until that’s fixed, more meetings won’t change the outcome.

Stop guessing what investors want. Get the next best move.

Within 48 hours of your Diagnostic, you’ll receive:

-

Investor Readiness Score (0–100) →so you know exactly where investors see risk.

-

Top 5 blockers (ranked) → so you stop fixing the wrong thing first.

-

30/60/90 roadmap → so you leave with a clear execution sequence.

-

Tightened narrative + ask logic → so you sound credible immediately.

-

Sprint vs 90-Day recommendation + entry criteria → so you know the fastest credible next step.

This is designed to give you clarity that changes your behaviour next week, not “ideas you’ll never implement.”

You won’t get a generic checklist. You’ll get a prioritised diagnosis for your business.

Pay in full. No subscriptions. No hidden upsells 5 Snapshot slots weekly. First come, first served.

Founder, services business

$2.4m revenue · raising in 6 months

I thought I had a pitch problem. It turned out to be underwriting.

Before the Snapshot, investor conversations were strong, then went quiet.

Angela showed us the real issue in one session: our proof and story weren’t lining up the way investors assess risk. The Readiness Score and ranked fixes were surgical.

Within a week, we stopped polishing the wrong things and rebuilt the narrative and priorities in the right order.

Investor conversations immediately felt more grounded and credible.

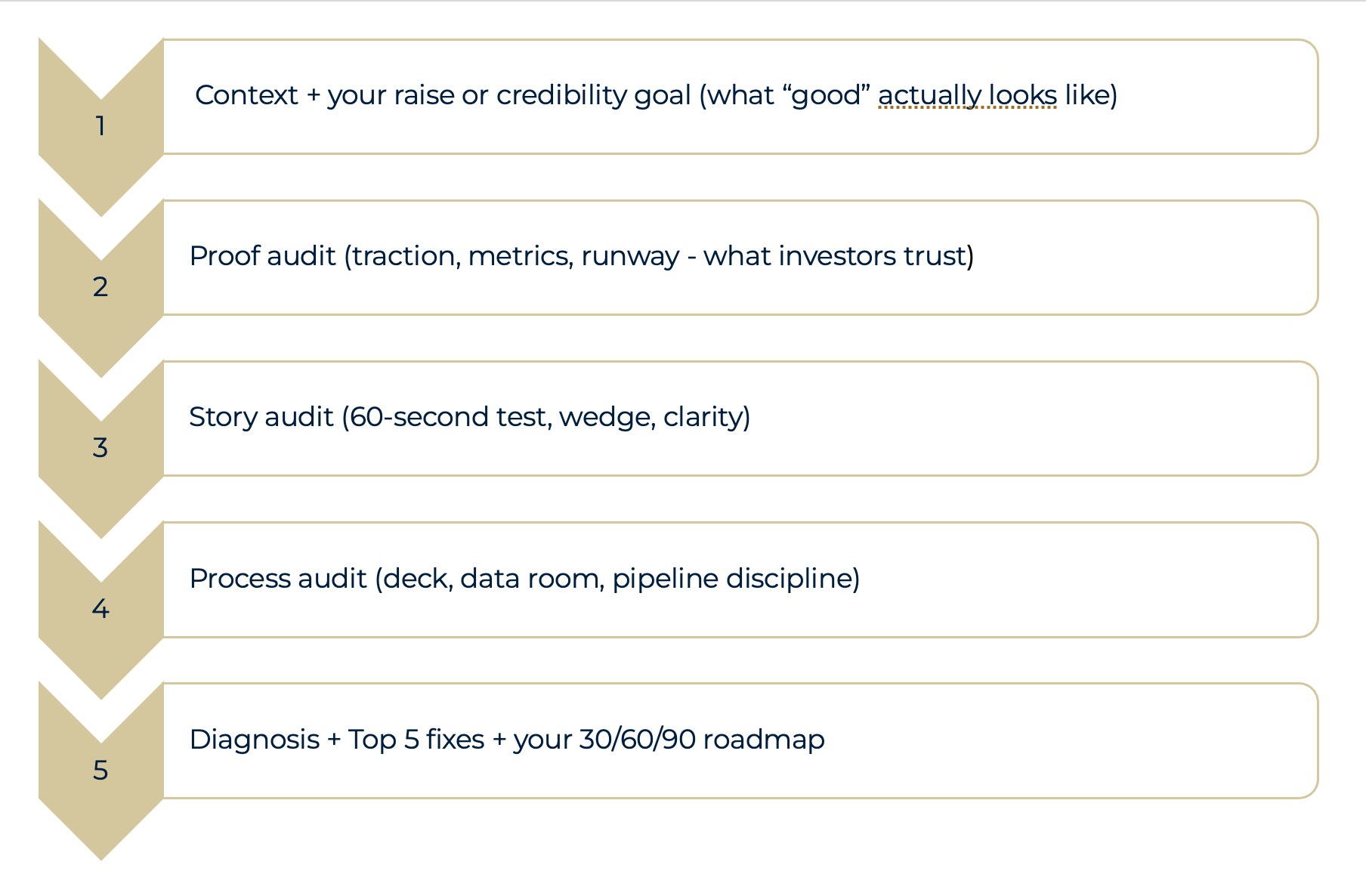

The Fundability Score (what investors actually respond to)

This is the same pattern investors use to decide whether to lean in - or quietly pass.

Most founders think they have a pitch problem.

They usually don’t.

Investors make decisions based on a pattern:

-

PROOF: numbers and traction they can trust

-

STORY: a narrative they can understand in 60 seconds

-

PROCESS: professional assets + follow-up cadence

-

FOUNDER READINESS: decision speed + execution under pressure

In your Diagnostic, we score each area and pinpoint exactly what’s blocking confidence.

Stop guessing why investors hesitate.

Founder, tech-enabled business preparing for a raise

“Angela is the opposite of fluffy. She’s an operator.

She showed us exactly why investors weren’t taking us seriously — and didn’t let us hide behind “the market.”

We left with a brutal diagnosis, a clear plan, and the assets to back it up. This saved us months of wasted meetings and expensive guessing.

How the Investor Readiness Snapshot Works (90 minutes)

No fluff. No generic advice. You’ll leave knowing exactly what to fix first.

Who’s running this diagnostic

I’m Angela Sedran - MD of Lionbridge Advisory.

I evaluate businesses the way investors do: proof, story, process, and execution under pressure.

This Snapshot is the same diagnostic lens I use to assess founder-led businesses for credibility, readiness, and next-step execution.

No funding promises. No generic advice. Just clarity you can act on.

This is for founders who want clarity fast - and will act on it.

Perfect if:

-

You’re a founder-led business planning to raise in the next 3–9 months or need investor credibility immediately

-

You’re getting “not yet” or silence and you’re sick of guessing

-

You’re willing to share basic numbers (rough is fine)

This is Not for:

-

Anyone seeking done-for-you fundraising

-

Anyone wanting guaranteed introductions

-

Anyone unwilling to execute weekly deliverables

-

Pre-revenue founders with no credible proof plan or willingness to build one

Stop guessing why investors hesitate.

What you walk away with within 48 hours

-

Investor Readiness Score (0–100) - so you know exactly where investors see risk

-

Top 5 fixes (ranked) - so you stop fixing the wrong thing first

-

30/60/90 roadmap - so you leave with a clear execution sequence

-

Narrative + ask tightening notes - so you sound credible immediately

-

Sprint vs 90-Day recommendation (with entry criteria) - so you know the fastest credible next step

-

30-min recorded follow-up - so you don’t second-guess the plan after the call

- A Cleanliness Check (governance + cap table + investor hygiene) and a Top 3 Risk Flags assessment.

This saves you from:

-

months of guessing

-

rebuilding the wrong deck

-

chasing investors who will never say yes

-

repeating the same first meetings that go nowhere

Founder, B2B business preparing for a capital raise

For the first time, fundraising feels like a process, not a panic.

The Diagostic didn’t just tell us what to fix. It gave us the order of operations.

We walked away with a clean narrative, investor-ready metrics, and a 30/60/90 plan we could actually execute.

The biggest shift was confidence: fewer wasted meetings, sharper answers, and a clear next move instead of constant second-guessing.

$997. One decision. No more second-guessing.

Includes:

-

2-page PDF diagnosis delivered within 48 hours

-

90-minute live Zoom audit

-

30-min recorded follow-up

Clarity Guarantee

If you complete the pre-call pack and attend the Snapshot and don’t walk away with a clear diagnosis and prioritised order of operations.

Fast-move credit

100% of your Diagnostic fee is credited toward the 4-week Sprint or 90-Day Accelerator if you enrol within 7 days. This credit expires 7 days after your Snapshot. No extensions.

90 minutes · 48-hour report · 5 diagnostic slots per week

Frequently Asked Questions

Will you raise capital for me?

No. We are not brokers or placement agents. We help you become investor-ready and fix what’s in your control.

Do you introduce investors?

No. We’re not brokers or placement agents. Investor exposure (if any) is for calibration and learning, never sold or guaranteed. We offer investor calibration/feedback opportunities for learning and readiness, and any introductions are discretionary and never sold as a product.

Is this legal advice?

No. We provide education and negotiation-readiness principles and recommend independent legal counsel.

What if I don’t have a deck?

That’s fine - the Snapshot will clarify what you need and in what order.

What do I need to prepare?

A short pre-call pack (numbers + any existing materials). You’ll receive it immediately after purchase.

What if I decide not to continue after the Snapshot?

That’s fine. The Snapshot is designed to stand alone. Many founders use it as a reset before deciding next steps.

Book your Investor Readiness Diagnostic now

Start getting the traction your business needs.

Stop guessing why investors hesitate.